Business

GCB’s profit before tax hits GH₵700m in first half of 2024

Published

8 months agoon

GCB Bank recorded strong profit growth in the first half of 2024 (1H 2024) compared to the same period in 2023.

This strong performance was primarily driven by a significant increase in customer deposits year-to-date (YTD), coupled with dedicated efforts at optimizing operational efficiency.

The 1H 2024 financial performance results from the Bank’s strategic shift to a strong focus on sales, transaction banking and a customer-centric approach.

Profit Before Tax for the period increased by 35 per cent year-on-year (y/y) to GHS 700.3 million, driven by growth in interest income and supported by a 21 per cent year-to-date increase in customer deposits and an increase in net fees and commission income.

Total revenue increased by 5 percent y/y to GHS 1.89 billion at 1H 2024.

Net interest income grew by 5 per cent y/y to GHS 1.43 billion in 2024, with net fees and commission income also increasing by 28 per cent to GHS 245.4 million.

Increased earnings from electronic services, trade services, processing and facility fees drove the net fees and commission growth over the half-year period.

Additionally, net trading income contributed GHS 211.8 million to revenue in 1H, 2024.

Operating expenses for 1H 2024 came in at GHS1.08 billion, up 17 per cent from GHS 921.1 million in 2023.

This increase was driven by inflation and currency depreciation pressures.

Impairment loss on financial assets for the period declined by 70 per cent y/y to GHS 104.8 million in 1H 2024.

This sharp decline in impairment loss resulted from the Bank’s enhanced risk management and risk mitigation strategies.

The balance sheet also grew substantially in the review period. Total assets surged to GHS 33.20 billion, representing a 22 per cent increase YTD.

A significant deposit growth, which reflects clients’ unwavering confidence in the Banks’ resilience amidst the prevailing macroeconomic uncertainties, underscored the increase in the balance sheet size.

Shareholders’ Equity surged by 15 per cent YTD to GHS 3.22 billion in 1H 2024 due to the increased profit for the period, bolstering the Bank’s financial performance and increasing shareholders’ value.

This growth in equity underscores our strong financial footing and demonstrates the Bank’s capacity to generate internal capital.

Earnings per share also grew, rising from GHS 2.52 in 1H 2023 to GHS 3.20 in 1H 2024. Also, the Capital Adequacy Ratio stood at 18.5 percent, well exceeding the regulatory requirement of 10 percent.

Return on Equity reached 26.2 per cent, reflecting efficient capital utilisation, while Return on Assets settled at 2.8 per cent.

Commenting on the 1H 2024 performance, Mr John Kofi Adomakoh, Managing Director of GCB Bank PLC, said: “GCB continues to record strong and higher quality earnings as well as improved returns to shareholders despite the challenges and uncertainties in the market combined with intensifying competition”.

Mr. Adomakoh explained that a strong focus on sales and transaction banking, growth in the Bank’s client base and growing relationships, stringent credit underwriting standards coupled with cost-effectiveness, strong governance, and effective risk management and control drove the 1H 2024 performance.

Concerning the intended capital raise, Mr. Adomakoh indicated that the Bank decided to put the capital raise on hold on the back of strong financial performance in 2023.

He revealed the Bank’s commitment to continue to rebuild capital through future profits while assessing capital requirements on an ongoing basis amidst heightened uncertainties in the operating environment and regulatory developments.

The GCB Managing Director shared Management’s commitment to maintaining optimal capital levels to support strategic and business objectives to drive long-term success and returns for shareholders.

The Bank’s 1H 2024 results thus confirm that GCB remains a beacon of financial stability and resilience, well-prepared to navigate the intricate financial landscape in Ghana with steadfastness, confidence and strategic foresight.

Source: citinewsroom.

You may like

Tooth decay cases rises in Tema

Cake Tekniks holds 59th graduation ceremony

Volta College Foundation donates GH¢9,000 to 9-yr-old fire victim

ICU holds Greater Accra regional youth, women confab

Beyond the cross: The role of women in Easter story

Empress Gifty to thrill patrons at MTN Stands In Worship on Easter Sunday

Business

Academia, industry need to collaborate for nation-building’

Published

4 days agoon

April 15, 2025The Chief Executive Officer of Telecel Ghana, Ms Patricia Obo-Nai, has advocated stronger collaboration between higher educational institutions and industry to prioritise the integration of industrial skills into academic curricula, asserting its relevance to nation-building.

Speaking at the 14th matriculation and 16th Congregation of the Ghana Christian University College (GCUC), she said the fast-changing global job market demands professionals skilled in tech skills and data science, stressing that the quality of human resources produced by academic institutions would determine the competitiveness of the country’s workforce.

The event was on the theme: ‘Inculcating industrial skills in academia: Key to nation building.’

“From my years of experience in industry, I dare to say that the quality of human resource is the most critical. The quality of graduates we produce from our tertiary institutions will determine the quality of our future workforce. Industries and universities will need to develop structured work readiness programmes to serve as the vital bridge between the world of education and the workforce,” she indicated.

Ms Obo-Nai pointed out that the rapid pace of change in consumer needs and business sustainability called for academia to stay ahead of industry trends to better prepare students for the workforce.

She shared a few key recommendations to help universities and students better align with industry needs, including revising curricula to add more industry input, partnering with industry for practical projects, and offering continuous opportunities for learning and knowledge exchange.

The ceremony, attended by members of the university’s Governing Council, Board of Trustees, university’s presidency, faculty, mentoring universities and guests, saw the successful matriculation of 356 fresh students and graduation of 186 students from the Faculty of Health Sciences and Faculty of Business Studies and Technology of GCUC.

Newly inducted president of GCUC, Rev. Dr James Yamoah, called for private sector support to improve the university’s infrastructure and realise their vision of training and churning out employable graduates.

“While our University College sees critical thinking as a necessity tool and therefore looking for any help that shall facilitate it so that our products will be able to compete favourably with their counterparts anywhere, we are also very much concerned about how our products will contribute to the efforts by the government and industries in building a robust economy that ensures employability and productivity with less or no graduate unemployment challenges,” Rev. Dr Yamoah added.

GCUC’s Governing Council Chairman, Prof. Samuel K. Offei, also added his voice to the call for external assistance from government and the private sector to improve the quality of holistic education the institution is delivering.

All is set for the presentation of Ghana’s budget statement and economic policy by the Finance Minister, Cassiel Ato Forson to Parliament today.

This would be the new government’s maiden budget since ascending to the throne in January.

Ghanaians are highly optimistic that the budget would go a long way to cushion people.

They are expecting that the National Democratic Congress (NDC) government will keep it promise and remove the E-levy, Betting Tax, and COVID-19 levy among other tax cuts.

Additional, it is expected that some measures will be introduced to stabilise the local currency and some prudent ways to ensure food security to reduce food inflation.

Ahead of that the Finance Minister has organised national economic dialogue, engageg over 60,000 youths on X, and market women among others to seek their views.

By Edem Mensah-Tsotorme

Business

New BoG building: $230m paid to contractor, $31.8m outstanding – Dr Asiama

Published

1 month agoon

March 5, 2025

The new Governor of the Bank of Ghana (BoG), Dr Johnson Pandit Asiama, has revealed that the state under the previous Nana Akufo-Addo administration has paid $230 million to the contractor working on the new BoG building project, with an outstanding balance of $31.8 million still owed to the construction firm.

He disclosed that the total cost of the project has risen to $261.8 million, with the payments to the contractor being made as recently as February this year.

“As of February this year, a total of approximately $230 million has been paid towards the project, with an outstanding balance of $31.8 million still due to the contractor,” he stated in parliament on Wednesday, March 5.

Dr Asiama also noted that an additional $48.3 million has been paid in taxes and levies associated with the construction of the building.

In addition to the main building, Dr Asiama explained that several other facilities were part of the project, including an Integrated Communication and Computing (ICC) system and Network Infrastructure, which cost $8.6 million.

Other expenditures included integrated electronic security systems at $15.8 million and furniture and furnishings, which amounted to $11.1 million.

He emphasised that these investments are aimed at ensuring the Bank of Ghana operates in a secure and technologically advanced environment, in line with the needs of a modern central bank.

In November 2024, former President Nana Akufo-Addo officially inaugurated the facility to serve as the new headquarters of BoG.

The state-of-the-art facility designed to symbolise financial strength and modernity is situated in the heart of the national capital.

The new facility marked a historic milestone in the evolution of the country’s central bank, which has been a pillar of the nation’s economic independence since its establishment in 1957.

Source: Myjoyonline.com

Tooth decay cases rises in Tema

Cake Tekniks holds 59th graduation ceremony

Volta College Foundation donates GH¢9,000 to 9-yr-old fire victim

Trending

Politics7 months ago

Politics7 months agoVoter Register Discrepancies: NDC to stage nationwide protests against EC

News8 months ago

News8 months agoArise Royals Montessori School Marks 2nd Graduation.

Entertainment9 months ago

Entertainment9 months agoGhanaian musician Champions Gaza Peace with New Track

News4 months ago

News4 months agoKing of Igbo Community in Ghana congratulates Mahama as President-elect of Ghana.

More8 months ago

More8 months agoYoung people urged to develop their talents

Entertainment10 months ago

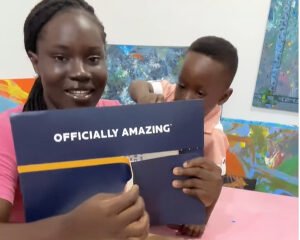

Entertainment10 months agoSteps to receive an official GWR certificate – Details from mother of a Ghanaian record holder

News10 months ago

News10 months agoCancer Support Network Foundation holds gala

Tech9 months ago

Tech9 months agoWatch out for sharks: The bizarre history of internet outages