Business

Africa Remittance Conference UK scheduled for September 21

-

News4 months ago

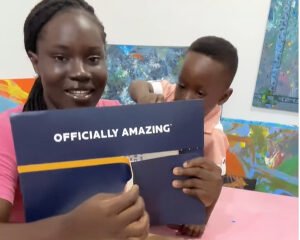

News4 months agoArise Royals Montessori School Marks 2nd Graduation.

-

Entertainment6 months ago

Entertainment6 months agoGhanaian musician Champions Gaza Peace with New Track

-

News6 months ago

News6 months agoDedicate a Portion of GDP for investment in AI to improve health and reduce poverty – Prof. Samuel Kojo Kwofie

-

Entertainment6 months ago

Entertainment6 months agoSteps to receive an official GWR certificate – Details from mother of a Ghanaian record holder

-

News5 months ago

News5 months agoExpatriate Palestinian Community build school, Mosque for Yizebisi

-

News2 weeks ago

News2 weeks agoKing of Igbo Community in Ghana congratulates Mahama as President-elect of Ghana.

-

Tech5 months ago

Tech5 months agoWatch out for sharks: The bizarre history of internet outages

-

News6 months ago

News6 months agoCSNF Educates Over 1,500 Students on Cancer Awareness and Screening